We provide highly reliable execution solutions for traders that are latency sensitive and require secure connectivity. As of 2021, we aggregate liquidity from 85 global banks that are connected to the electronic trading network placing us amongst the deepest liquidity pools in currency trading.

Furthermore, money managers are offered Request for Streams, Algo-trading, Benchmark Trading, Executable Streaming Prices, API connectivity (a whole range of FIX solutions across all the platforms), automated order functionality and complete Prime Brokerage services with fully integrated STP (Straight Through Processing).

Precise and real-time price feed includes full market depth bringing in the ability for participants to exploit minimal price divergences across all markets traded. Most importantly, we minimize ping by utilizing strategically-located data centers throughout the world.

A broad spectrum of various order types can be executed through our real-time streaming execution solution.

SOUNDS REPORTING

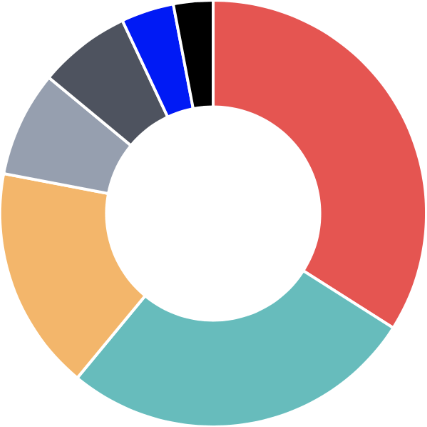

Comprehensive data in one place.We have put all our expertise into creating a brand new backoffice interface called APLynx ™. Whichever market is traded, APLynx summarizes all the relevant information on a single screen with full adjustability for money managers. A number of specialized reports can be run, supplemental reports can be generated, VaR & Portfolio analysis, margin reports can be requested as well. For the end-clients, APLynx shows the statistics focused on absolute clarity: Deposits, Return and Equity.